The tax written down value of the asset is $2,000. A remote work allowance is a stipend that employers pay employees who are working from home for things like internet or office supplies.

31 Tips Are Work Allowances Taxable For Small Space, As a keeper of an educational institution, the allowance received is fully taxable. If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as.

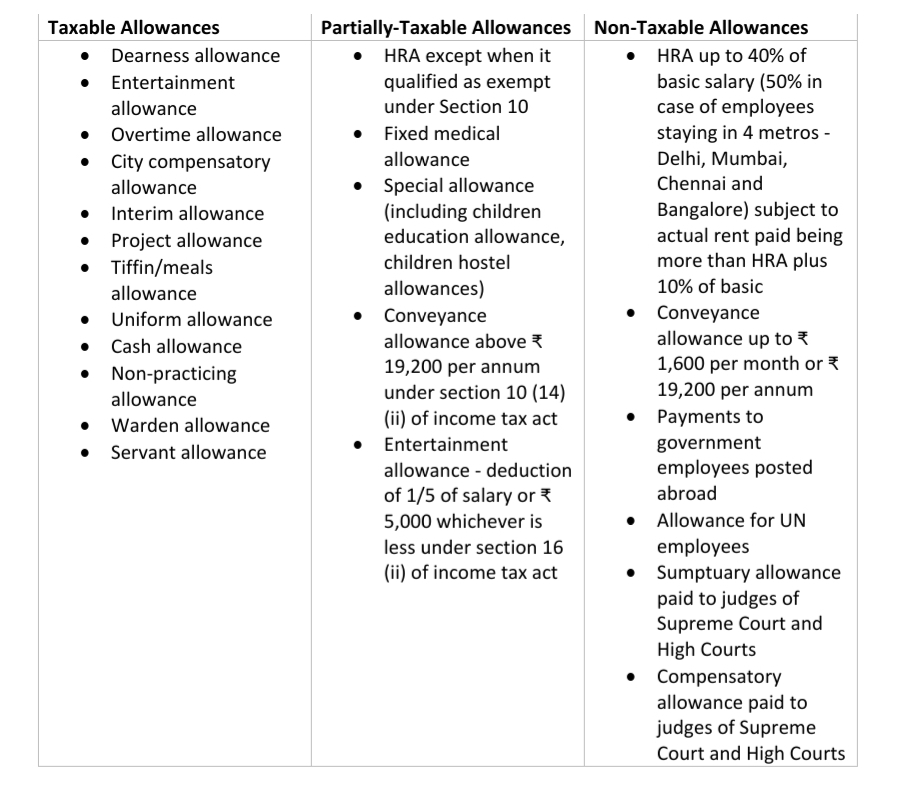

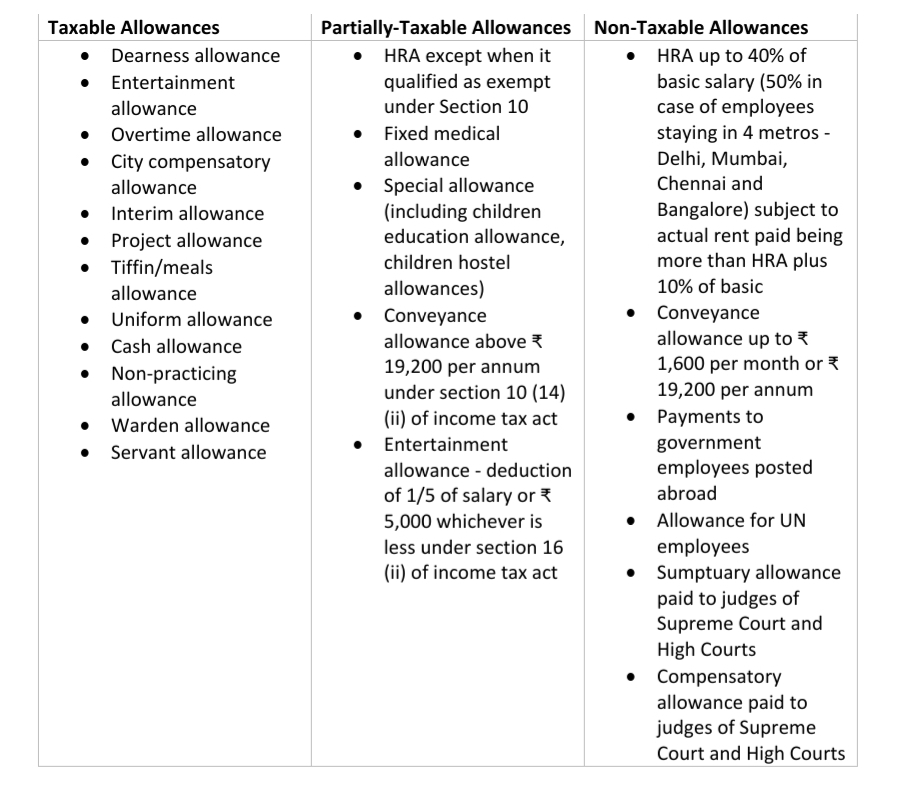

What are Allowances and types of Allowances? upload form16 From trutax.in

What are Allowances and types of Allowances? upload form16 From trutax.in

Web is a work allowance taxable? Allowances given to supreme court /. Government civilian employees for working abroad are taxable. A remote work allowance is a stipend that employers pay employees who are working from home for things like internet or office supplies.

What are Allowances and types of Allowances? upload form16 Hence, these require cpf contributions.

If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as. If the employee uses the benefit 100% for work, it is tax free. Some examples include grooming allowance,. Web payments received by u.s.

Source: carajput.com

Source: carajput.com

As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and reporting obligations. Web many allowances provided by the company is actually considered taxable income for employees. It’s designed to help workers cover their expenses while working remotely. Web a remote work allowance, or remote work stipend, is a monetary sum paid to employees. Key takeaways on Taxable, Nontaxable & Partly Taxable Allowances.

Source: youtube.com

Source: youtube.com

Web food allowances, eg payments to subsidise meals at a workplace cafe or canteen; You can also see the rates and bands without the personal allowance. Web overtime meals or allowances. Web giving you employee, vanisha an allowance towards a pair of nice work shoes every year; Restriction of Personal Allowance ACCA Taxation (TXUK) Exam FA2019.

Source: teachoo.com

Source: teachoo.com

Web giving you employee, vanisha an allowance towards a pair of nice work shoes every year; Government civilian employees for working abroad, including pay differentials, are taxable. Web the employer subsequently transfers the asset to the employee in ya 2022, i.e. Generally, if you provide accommodation or an. What are Allowances and Perquisites TDS on Salary with Allowances.

Source: holden-partners.co.uk

Source: holden-partners.co.uk

Generally, if you provide accommodation or an. However, certain foreign areas allowances, cost of. Work in unpleasant or hazardous. Web payments received by u.s. Budget 2020 Summary Holden & Partners.

Source: rma-accountants.com

Source: rma-accountants.com

Web april 13, 2022. Web overtime meals or allowances. However, certain foreign areas allowances, cost of. Tax reliefs, rebates & deductions receive tax bill, pay tax, check refunds; How does the new taxfree trading allowance work? RMA ACCOUNTANTS.

Source: carajput.com

Source: carajput.com

Web food allowances, eg payments to subsidise meals at a workplace cafe or canteen; As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and reporting obligations. You can also see the rates and bands without the personal allowance. Web if an employer pays an allowance to an employee working as a warden i.e. Key takeaways on Taxable, Nontaxable & Partly Taxable Allowances.

You can also see the rates and bands without the personal allowance. But the value of any personal use of a working condition fringe benefit must be included. Allowances given to supreme court /. As a keeper of an educational institution, the allowance received is fully taxable. How To Calculate Capital Allowance In Taxation Malaysia.

This is an allowance paid by the employer when the employee or any of his family members fall sick for the cost incurred on their treatment. Web what is taxable, what is not; If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as. Web giving you employee, vanisha an allowance towards a pair of nice work shoes every year; Malaysia Taxation Junior Diary Capital Allowance Schedulers.

Source: pinterest.com

Source: pinterest.com

If you provide benefits to your employees, you always have to go through the same steps. As a keeper of an educational institution, the allowance received is fully taxable. Web fixed medical allowance: The housing is provided on the property owned by the business or. List of Taxable Allowances Salary Tax Finance info Salary.

Web allowances are extra payments made to employees who: Web a sales rep might receive $575 as a monthly car allowance, for example, and the employer counts this as compensation for wear and tear on their personal vehicle. Web if an employer pays an allowance to an employee working as a warden i.e. Web such allowances include handphone, transport, meals, clothing, overseas expenses, and even good attendance, festive allowance and others also require cpf. Is Allowance Taxable In Malaysia Samirrfg.

Source: carajput.com

Source: carajput.com

Web a remote work allowance, or remote work stipend, is a monetary sum paid to employees. Use their own tools at work. Web a sales rep might receive $575 as a monthly car allowance, for example, and the employer counts this as compensation for wear and tear on their personal vehicle. If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as. Key takeaways on Taxable, Nontaxable & Partly Taxable Allowances.

Source: settlerdesign.blogspot.com

Source: settlerdesign.blogspot.com

Under the simplified tax treatment, the open. Hence, these require cpf contributions. Have a particular skill they use at work. However, certain foreign areas allowances, cost of. Living Away From Home Allowance Etu settlerdesign.

Source: contadorinc.co.za

Source: contadorinc.co.za

Web food allowances, eg payments to subsidise meals at a workplace cafe or canteen; Work in unpleasant or hazardous. Web if an employer pays an allowance to an employee working as a warden i.e. Web allowances are extra payments made to employees who: Travel Allowance or Company Car Which Is Better? Contador Accountants.

Source: taxf.blogspot.com

Source: taxf.blogspot.com

If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as. Web a sales rep might receive $575 as a monthly car allowance, for example, and the employer counts this as compensation for wear and tear on their personal vehicle. Web what is taxable, what is not; But the value of any personal use of a working condition fringe benefit must be included. How To Work Out Tax On Car Allowance Uk TAXF.

Source: trutax.in

Source: trutax.in

Web the employer subsequently transfers the asset to the employee in ya 2022, i.e. Web if an employer pays an allowance to an employee working as a warden i.e. Web overtime meals or allowances. If the employee uses the benefit 100% for work, it is tax free. What are Allowances and types of Allowances? upload form16.

Source: wrensterling.com

Source: wrensterling.com

Web is a work allowance taxable? Have a particular skill they use at work. Web accommodation allowances when an employer pays for accommodation on behalf of an employee, or pays an accommodation allowance to an employee. You can also see the rates and bands without the personal allowance. Changes to the tapered annual allowance 2020.

Source: slideshare.net

Source: slideshare.net

Tax reliefs, rebates & deductions receive tax bill, pay tax, check refunds; Web the employer subsequently transfers the asset to the employee in ya 2022, i.e. Web home working allowance. This is an allowance paid by the employer when the employee or any of his family members fall sick for the cost incurred on their treatment. Allowance ppt.

Source: youtube.com

Source: youtube.com

Web accommodation allowances when an employer pays for accommodation on behalf of an employee, or pays an accommodation allowance to an employee. Hence, these require cpf contributions. Web the phrase ‘remote work allowance’ can also be used to mean ‘remote work stipend’, which is a sum of money given to remote workers by their employer to help pay for the extra. Generally, if you provide accommodation or an. Personal Taxation of Car Allowance in Canada YouTube.

Source: cagmc.com

Source: cagmc.com

Web is a work allowance taxable? Under the simplified tax treatment, the open. Web allowances are extra payments made to employees who: Web april 13, 2022. Tax Treatment of Allowances and Perquisites under Head Salary.

Source: youtube.com

Source: youtube.com

Have a particular skill they use at work. Clothing allowances, eg to buy a suit to wear at work (but not a uniform) free or subsidised board,. Web is a work allowance taxable? Web what is taxable, what is not; Preparing the Capital Allowance Computation, Non Pool Assets ACCA.

Source: farnoushdesign.blogspot.com

Source: farnoushdesign.blogspot.com

Under the simplified tax treatment, the open. However, certain foreign areas allowances, cost of. As an employer providing homeworking expenses for your employees, you have certain tax, national insurance and reporting obligations. If a step does not apply to you, skip it and go on to the next. Car Allowance And Mileage Claim.

Source: freelancetotalrewards.com

Source: freelancetotalrewards.com

Web giving you employee, vanisha an allowance towards a pair of nice work shoes every year; Web overtime meals or allowances. Clothing allowances, eg to buy a suit to wear at work (but not a uniform) free or subsidised board,. If you work from home, your employer can pay you a home working allowance to reimburse you for additional household expenses, such as. Are your Expatriate Allowances Right? (part 1) Freelance Total Rewards.

Source: allstarcard.co.uk

Source: allstarcard.co.uk

It’s designed to help workers cover their expenses while working remotely. Web fixed medical allowance: Web payments received by u.s. Web allowances are extra payments made to employees who: A guide to vehicle allowances Allstar.

Source: carajput.com

Source: carajput.com

This includes payments such as a fixed monthly housing, handphone,. Web if an employer pays an allowance to an employee working as a warden i.e. Web food allowances, eg payments to subsidise meals at a workplace cafe or canteen; However, certain foreign areas allowances, cost of. Key takeaways on Taxable, Nontaxable & Partly Taxable Allowances.

Source: youtube.com

Source: youtube.com

Web overtime meals or allowances. Government civilian employees for working abroad, including pay differentials, are taxable. Monetary payments that increase the employees' wages, are also wages. Web if an employer pays an allowance to an employee working as a warden i.e. Balancing Adjustments on Pools and Review of Capital Allowance.

Generally, If You Provide Accommodation Or An.

This is an allowance paid by the employer when the employee or any of his family members fall sick for the cost incurred on their treatment. Web overtime meals or allowances. Web if an employer pays an allowance to an employee working as a warden i.e. However, certain foreign areas allowances, cost of.

Web Home Working Allowance.

If a step does not apply to you, skip it and go on to the next. Web a remote work allowance, or remote work stipend, is a monetary sum paid to employees. Web fixed medical allowance: If the employee uses the benefit 100% for work, it is tax free.

Web Payments Received By U.s.

Web giving you employee, vanisha an allowance towards a pair of nice work shoes every year; Web allowances are extra payments made to employees who: Web accommodation allowances when an employer pays for accommodation on behalf of an employee, or pays an accommodation allowance to an employee. You do not get a personal.

Web Food Allowances, Eg Payments To Subsidise Meals At A Workplace Cafe Or Canteen;

Web the phrase ‘remote work allowance’ can also be used to mean ‘remote work stipend’, which is a sum of money given to remote workers by their employer to help pay for the extra. Government civilian employees for working abroad are taxable. Under the simplified tax treatment, the open. Have a particular skill they use at work.